For many associations and chambers, member and event invoicing is still powered by outdated financial management software—or worse, cobbled together from spreadsheets and email threads. It might seem routine, but in reality, invoicing is one of your most visible financial workflows, and when it breaks, the impact is immediate. Slow reconciliations, billing errors, and patchwork payment tracking all chip away at credibility, cash flow, and member trust. Glue Up's AI-powered financial management software simplifies complex invoicing and makes finance teams faster, smarter, and more aligned.

You don't just automate invoices and payment collection—you create a system that works like a strategic asset:

Set rules once and apply them everywhere. Customize fields, pricing logic, and tax rules to reflect your operations—not generic software templates.

Trigger invoices automatically. Bill members, sponsors, and event participants based on real-time actions and registrations—no follow-ups needed.

Track payments inside your CRM. See who paid, when, and how—without switching systems or pulling extra reports.

Run clean financials without cleanup. Access polished, presentation-ready reports for your board, CFO, or next funding discussion.

You already know the pain of broken billing cycles and scattered spreadsheets. Let's fix that.

Book a demo with our team. We'll show you how Glue Up replaces manual invoicing, scattered payment records, and endless follow-ups with a clean, automated system built for member-based organizations.

No finance background needed. No messy integrations. Just a clear, customized walkthrough of how it works for your events, dues, and reports.

First Things First: Build Custom Fields That Reflect How You Work

Let's be honest—your finance workflows aren't generic. So why keep relying on invoicing tools that assume they are?

Before you automate anything, start at the root. Your billing system needs to understand your structure by mapping real-world logic: member categories, chapter-level fees, sponsorship deals, and hybrid pricing for events.

Glue Up's Custom Fields give you that control—without needing IT.

No more forcing complex billing rules into generic templates. With custom logic baked into every transaction, our platform becomes both an automated invoicing system for associations and a CRM-integrated invoicing solution designed around your structure—not someone else's software assumptions.

Here's how you can use it:

Build logic for membership billing automation based on join date, renewal tier, or benefit level.

Auto-tag every invoice by chapter, program, or revenue source for frictionless financial reporting for membership software.

Add fields for grants, sponsorships, or donations—no external workarounds or spreadsheet patches.

USBC Did It—See How It Worked Out for Them

The U.S. Black Chambers, Inc. (USBC) needed more than just a basic billing system. As they expanded nationally and introduced new programs, their legacy tools couldn't keep pace with how they billed sponsors, tracked renewals, or managed member payments.

Glue Up gave them precisely what they needed—financial management software for associations that reflected their operations.

They built custom fields for regional chapters, added logic for recurring sponsorship payments, and tracked every invoice inside one connected system. No toggling between spreadsheets. No double entries. Just clean, contextual invoicing backed by real-time data.

Want to achieve the kind of operational clarity and momentum USBC unlocked? See how Custom Fields are set up live and build your version of financial success.

Make Tax Rules Work for You—Not Against You

If your tax logic lives outside your system, you're always one step behind.

By now, you've tailored how your invoices behave with custom fields—but financial accuracy isn't just about inputs. It's about compliance, especially when managing payments across states, programs, or revenue streams.

Member-based organizations like yours often juggle grants, dues, sponsorships, and ticketed events—all taxed differently. One mistake and your finance team spends hours chasing corrections instead of insights.

Glue Up's tax-compliant billing for global member organizations turns a liability into leverage:

Apply specific tax rules to different member tiers, regions, or services

Auto-detect exemptions and apply them in real-time—no manual overrides

Keep auditors happy with clean, exportable tax documentation at every level

This isn't just smart—it's protection. And when paired with Glue Up's AI accounting tools, you're not just collecting payments; you're operating with precision.

Set Up Smarter Tax Rules in Minutes—Avoid Hours of Cleanup Later

Here's how to configure tax-compliant billing for member organizations in Glue Up so your team never has to guess again:

Go to Financial Settings → Tax Rules

Create rule categories for each type of transaction: membership, sponsorship, event, donation, etc.

Define tax percentages for each rule (e.g., 0%, 5%, 8.25%)

Assign Rules by Member Type or Product

Example: Sponsors in one state may require an 8.25% tax, while donors are exempt.

Apply rules directly to pricing structures or specific invoice templates.

Auto-Detect Exemptions

Enable exemption logic by region or member tag. For instance, "Government Agency" or "Nonprofit Partner" tags can bypass default tax settings.

Link to Reporting Modules

Automatically sync tax data with Glue Up's financial reporting for membership software to avoid reconciliation delays and audit stress.

Pro Tips from the Field

Want to get it right the first time? These quick tips will help you configure smarter tax rules without second-guessing—or circling back later to clean up mistakes:

Use Tags and Groups in CRM to assign tax rules at scale. Avoid doing it one by one.

Preview invoices with test data before launching your first automated cycle.

Document your rule logic once inside your internal SOP—Glue Up lets you reuse and clone workflows across event types and member tiers.

Once you're set up, your team will stop asking, "Is this taxable?" and focus on revenue, not risk.

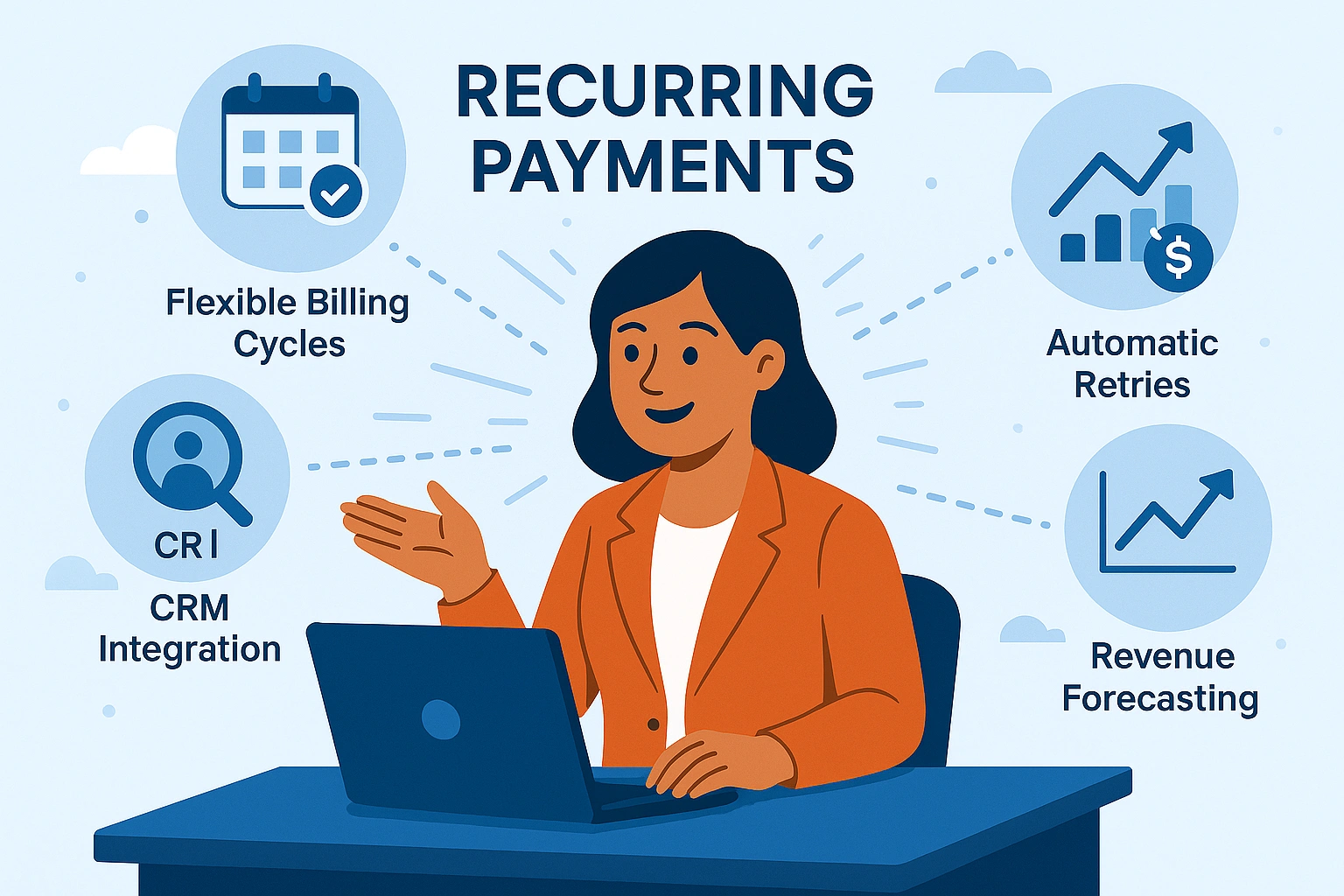

Make Recurring Payments Work for You—Not the Other Way Around

You've customized your fields and nailed your tax rules. Now comes the real payoff: recurring billing. And this isn't just about convenience—it's about control, cash flow, and predictable forecasting for your entire operation.

Our automated renewal system doesn't stop at billing on time. It accounts for variable member types, funding cycles, sponsor tiers, and auto-renewal logic—all mapped to your workflows, not guesswork.

Here's what you can set in motion with Glue Up:

Create Custom Billing Cycles that Match Your Membership Structure

Use automated billing tied to member type, join date, or sponsor category—perfect for chambers managing multiple tiers. A chamber in Georgia, for example, bills nonprofits annually and business sponsors quarterly—Glue Up makes that setup a one-time configuration.

Recover Revenue Automatically with Smart Retry Workflows

Turn failed transactions into resolved payments with built-in retry logic and personalized alerts. If a member's card fails during renewal week, Glue Up automatically retries the payment, notifies them, and updates your dashboard—no manual follow-up required.

Drive Renewals With CRM-Linked Member Engagement

Tie billing to activity data inside your CRM. Automate reminders, re-engagements, and renewal nudges through membership billing automation that improves retention. If an annual member who hasn't attended an event in six months is approaching renewal, Glue Up sends a personalized message with upcoming event highlights and a renewal link.

Present Confident Numbers With Predictive Revenue Tracking

Sync billing with Glue Up's financial reporting to forecast cash flow, spot trends, and brief leadership with clarity. Need a breakdown of monthly recurring revenue across five chapters for your CFO? It's already visualized and ready to download—filtered by chapter, member type, and payment status.

TBREIA Built a Smarter Billing and Member Conversion Workflow—Here's What Happened

Tampa Bay Real Estate Investors Association (TBREIA) is a real estate investors group with over 1,200 active members across Florida. But behind the scenes, billing delays and manual payment tracking slowed everything down.

Things changed fast once they switched to Glue Up's automated invoicing system for associations. Guest ticketing, smart payment retries, and CRM-tied renewal workflows eliminated busywork—and unlocked real revenue visibility.

Member conversions rose, finance got accurate, and growth stopped depending on guesswork.

Want your billing to grow with your membership like TBREIA? Schedule a quick live demo with our experts to map your billing setup—member tiers, event fees, tax rules, etc. We'll configure your CRM-integrated invoicing solution to fit your workflows from day one.

Turn Small Features Into Big Wins With Built-In Controls For Your Team

By now, you've seen how Glue Up handles the heavy lifting—AI-powered invoicing, subscription billing software for member-based organizations, and more. But there's a layer of polish that only shows up when the right tools quietly do their job.

Check out other strategic tools and features you can use to reduce busywork and protect your revenue:

Handle International Billing Like a Pro

Running programs across borders? Bill in local currency and auto-convert to your main ledger—no manual updates. Your financial reporting stays aligned, even with global operations.

Control Access and Protect Financial Workflows

Set granular, role-based permissions so only the right team members can view or edit finance data. That's tighter oversight—without extra software.

Boost Non-Dues Revenue With Instant Upgrades

Selling add-ons like VIP tickets, merch, or post-event sessions? Create itemized upsells directly in your event finance management tools. Attendees choose more, you earn more—on autopilot.

Stay Audit-Ready Without the Scramble

Every invoice edit, payment update, and rule change is automatically logged. When it's time to report, your data is clean, exportable, and accurate—no digging.

Still relying on spreadsheets and gut instincts? We can change that!

Skip the plug-ins and patchwork. Schedule a quick finance workflow session and devise a setup that fits your structure—from regional dues and tiered billing to international taxes and CRM-linked renewals.

Wondering If Your Team Can Handle Our AI-Powered Financial Management Software?

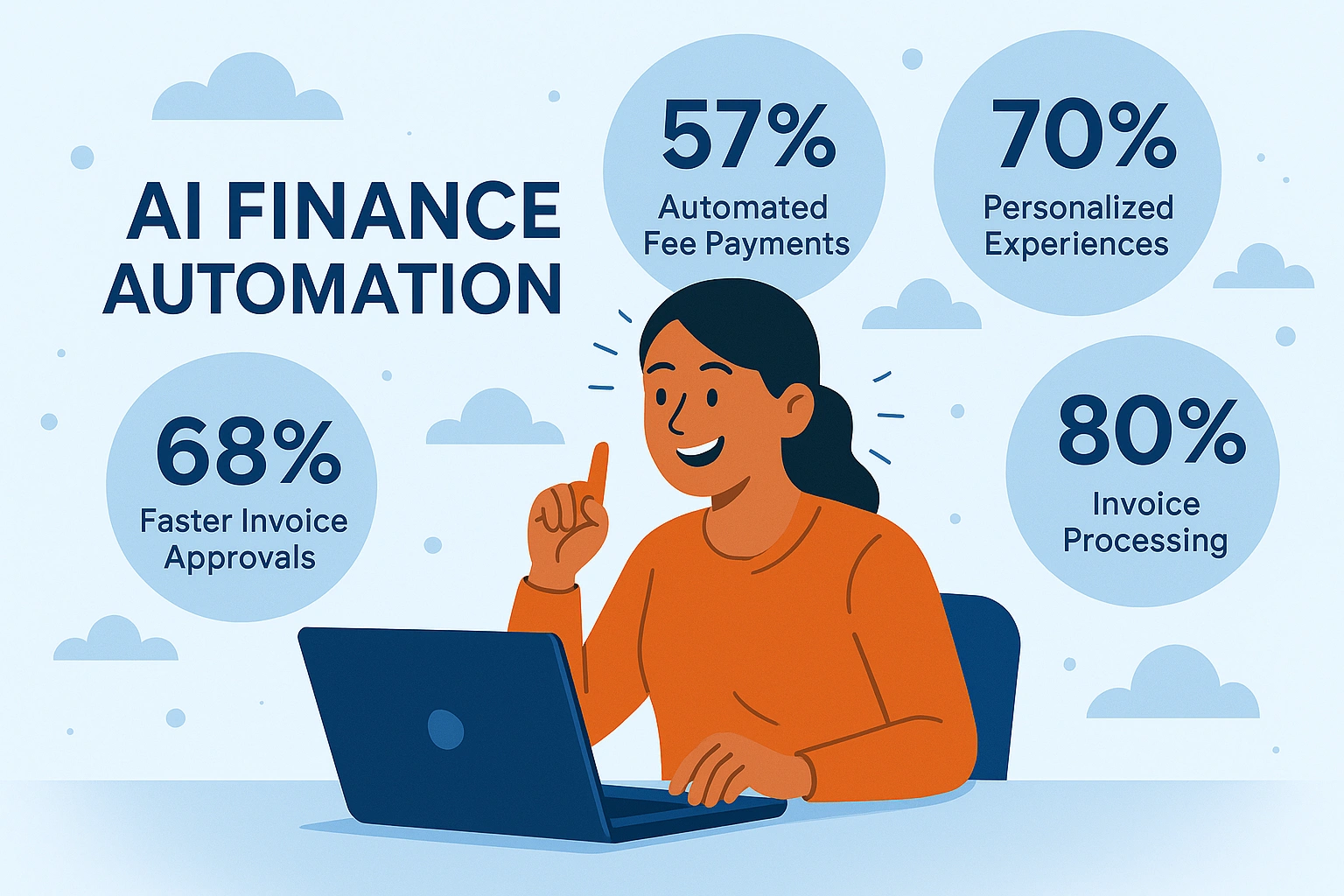

The Stats Might Surprise You—AI in Finance Is Becoming Standard

We get it. Every financial management platform promises to be "intuitive." But you're the one managing the hand-holding, the how-do-I-do-this emails, and the silent frustration when systems don't deliver.

Switching to a new invoicing or event finance system feels risky. What if it slows things down before it speeds them up? What if your team doesn't adopt it?

That hesitation is real. But what if we told you AI in finance isn't some distant innovation—it's already the new normal?

From invoicing and payment tracking to reconciliations and audit prep, large associations and chambers are quietly automating the financial grunt work that used to drain hours and cause errors. The shift isn't about hype. It's about survival in an industry where member expectations are rising, staff capacity is tight, and financial visibility can't wait.

Here's what the research shows:

The MTM Agency reports that 57% of membership bodies have implemented automation for tasks like annual subscription fee payments

According to Twilio's State of Nonprofit Digital Engagement Report, 70% of nonprofit organizations now see AI as their go-to solution for delivering personalized experiences and improving member interactions.

McKinsey's research on process outsourcing indicates that automating billing and invoice payments end-to-end is one of the most effective steps organizations can take.

According to Dokka's Electronic Payment Trends, 80% of invoice processing is now automated in the average organization. Manual follow-ups and rework are rapidly becoming the exception.

IOFA's 2024 Accounts Payable Automation Report reveals that 68% of global finance leaders report faster and more accurate invoice approvals after adopting AI automation.

It's Time to Catch Up—We'll Walk With You Every Step

If you're running a large association or chamber, the numbers above aren't just trends—they're your reality. With multiple revenue channels, complex member tiers, and dozens of events a year, invoicing is a pressure point, not just routine. And without automation, every new initiative adds more manual work, room for error, and time lost.

This is why we don't just drop our all-in-one financial management software on your desk and call it a day.

We provide:

A dedicated implementation specialist who maps the system to your existing workflows.

Built-in training modules, onboarding webinars, and how-to videos designed for your actual use cases.

A searchable Help Center, Knowledge Base, and real humans on live chat when needed.

Pre-built templates and workflows to get your invoicing engine running without rebuilding from scratch.

And unlike open-ended tools that expect you to build the logic yourself, Glue Up comes pre-configured for event-based, membership-driven financial workflows, so your team can skip the learning curve and get straight to results.

Let's be real. Change is never effortless. But we make it achievable and worth it. Schedule a live walkthrough right away and configure your invoicing to match your membership tiers, event fees, and recurring revenue needs—no patchwork systems, no missed payments.