Automated dues revenue reporting shapes how early December feels inside most associations as inbox traffic eases, calendars open up, and conversations shift from execution toward reflection.

Leadership teams gather financial summaries, membership updates, and renewal reports, all circling the same quiet question that defines the season: Where do we actually stand going into next year?

For member-based organizations, the answer sits inside dues revenue. Membership dues remain the most stable and meaningful source of income for associations, chambers, and professional groups. Stability creates reassurance, while clarity creates confidence. What matters at year end is how clearly that revenue translates into insight leadership teams rely on when planning the new fiscal year.

That translation begins with automated dues revenue reporting. When dues activity flows through a structured system, it becomes more than income. It becomes context. It becomes visibility. It becomes confidence. In 2026, organizations that plan well treat automated dues revenue reporting as financial infrastructure that supports decision making, rather than as a background administrative task.

This article explores how that shift takes shape, why it elevates year end planning conversations, and how Glue Up supports organizations that want their numbers to speak clearly when it matters most.

Key Takeaways

By December, leadership teams ask where the organization truly stands heading into the new fiscal year. Automated dues revenue reporting answers that question with consistency and confidence, giving teams a shared, reliable view of dues performance instead of last-minute estimates or stitched together spreadsheets.

Membership dues reflect renewal confidence, perceived value, and long-term sustainability. Automated dues revenue reporting reveals these signals through year over year comparisons, lifecycle tracking, and category level insights, allowing leaders to make informed tradeoffs when planning budgets and priorities.

When executives, finance teams, and boards rely on the same structured data, planning conversations move forward faster. Automated dues revenue reporting supports steadier meetings, clearer financial summaries, and more focused discussions grounded in evidence rather than assumptions.

Reducing manual reconciliation, documentation, and reporting work allows finance teams to shift from record keeping to analysis. Automated dues revenue reporting improves accuracy, supports audit readiness, and preserves financial integrity while freeing time for insight driven planning.

When dues reporting becomes a shared language across finance, membership, and leadership teams, alignment improves naturally. Automated dues revenue reporting supports this cultural shift, helping mature organizations enter the new fiscal year with confidence, preparation, and a clear understanding of their financial position.

Quick Reads

Automated Dues Revenue Reporting as the Foundation of Year End Planning

Every planning conversation starts with revenue reality.

Budgets, staffing plans, program investments, and board commitments all depend on a shared understanding of available resources. For member organizations, that understanding centers on dues. Yet many teams approach dues revenue as a ledger item rather than a living signal.

Automated dues revenue reporting changes that relationship.

Instead of pulling numbers together late in the cycle, leadership teams work from a consistent view of dues activity throughout the year. Invoices, payments, renewals, and member categories remain connected inside a single system. By the time year end arrives, the story behind the numbers already feels familiar.

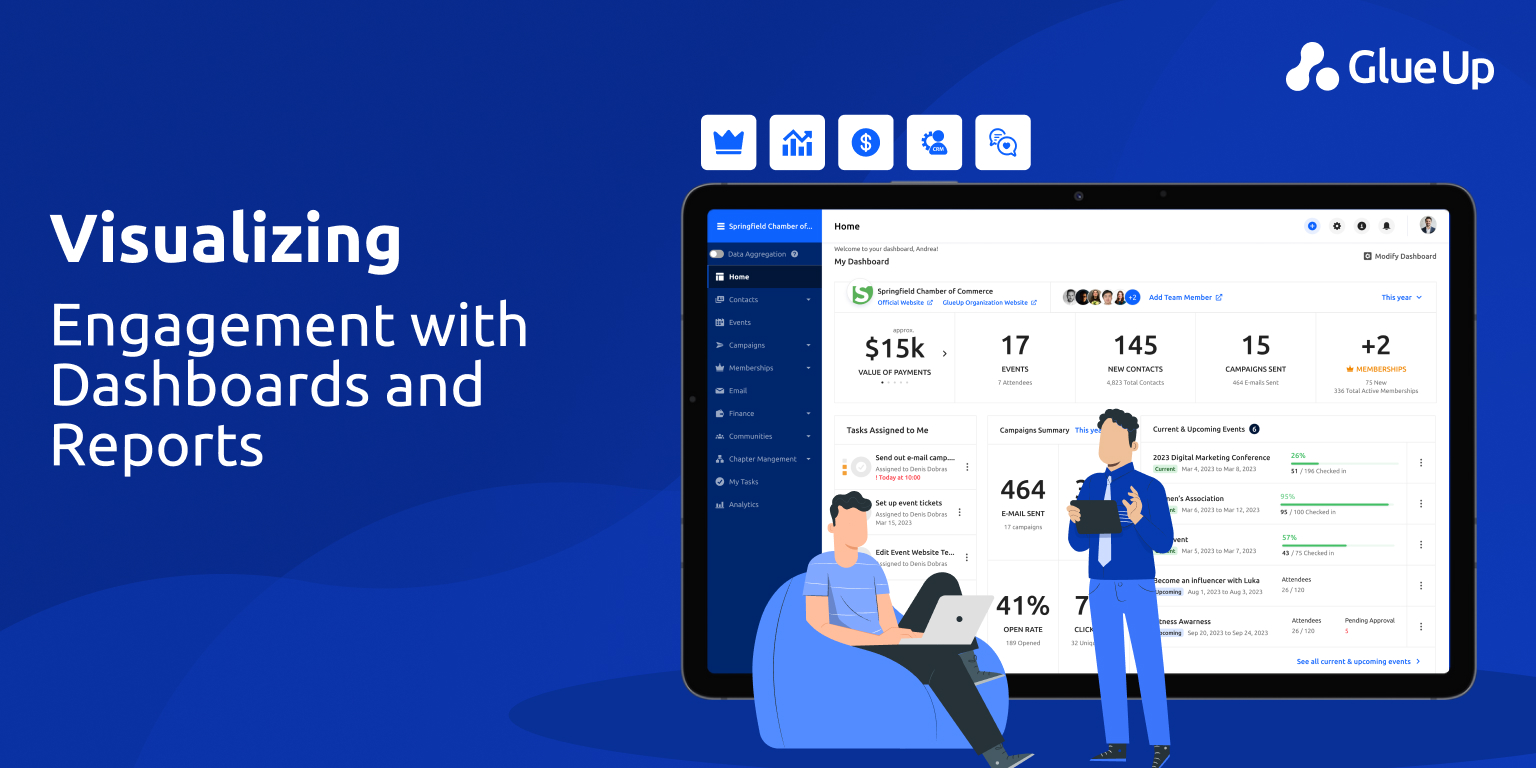

Glue Up supports this shift by unifying membership records, billing activity, and financial reporting in one environment. Automated dues revenue reporting through native finance dashboards allows teams to see where revenue stands relative to expectations, budgets, and historical patterns without relying on manual reconciliation.

The impact shows up quickly. Fiscal year end planning moves faster. Board conversations feel steadier. Finance teams spend more time interpreting trends and less time assembling spreadsheets.

From Transactions to Signals How Dues Reveal Organizational Health

Membership dues tell a story long before year end.

Each renewal reflects confidence. Each delay highlights friction. Each membership tier signals perceived value. When organizations track dues activity through automated dues revenue reporting, patterns emerge that shape planning discussions naturally.

Historical year over year revenue comparison reveals growth trajectories. Membership category revenue breakdown clarifies which segments contribute most consistently. Dues to budget variance analysis highlights areas where expectations and reality diverge.

These insights matter because planning always involves tradeoffs. Leaders decide where to invest based on what feels sustainable. Automated dues revenue reporting supplies the evidence that supports those decisions.

Glue Up captures this data at the source. Member profiles connect directly to dues records. Invoices and receipts stay tied to membership status. Renewal activity updates financial views in real time. Over time, dues lifecycle tracking builds a reliable archive of how revenue behaves across cycles.

That archive becomes indispensable when leadership teams prepare for the next fiscal year.

Why Real Time Visibility Shapes Better Leadership Decisions

Financial clarity influences behavior.

When leaders trust the numbers in front of them, conversations move forward. When uncertainty creeps in, discussions circle familiar ground. Automated dues revenue reporting shifts organizations toward the first outcome.

Real time membership renewal analytics show how current performance compares to prior years. Automated accounts receivable aging reports highlight outstanding balances without guesswork. Deferred revenue recognition tracking supports accurate financial statements aligned with accounting standards.

Glue Up presents this information through dashboards designed for decision makers rather than technicians. Executive directors view planning dashboards that summarize performance at a glance. Board treasurers receive financial summaries grounded in consistent logic. CFO level revenue visibility supports thoughtful budget development rather than reactive adjustments.

The result feels subtle yet powerful. Leadership meetings gain focus. Financial updates earn trust. Planning becomes collaborative instead of corrective.

Automated Dues Revenue Reporting and the Discipline of Fiscal Year End Closing

Year end closing reveals process maturity.

Organizations that rely on fragmented systems experience a familiar scramble. Data exports pile up. Reconciliations stretch across days. Audit preparation feels heavier than expected. Automated dues revenue reporting changes that experience.

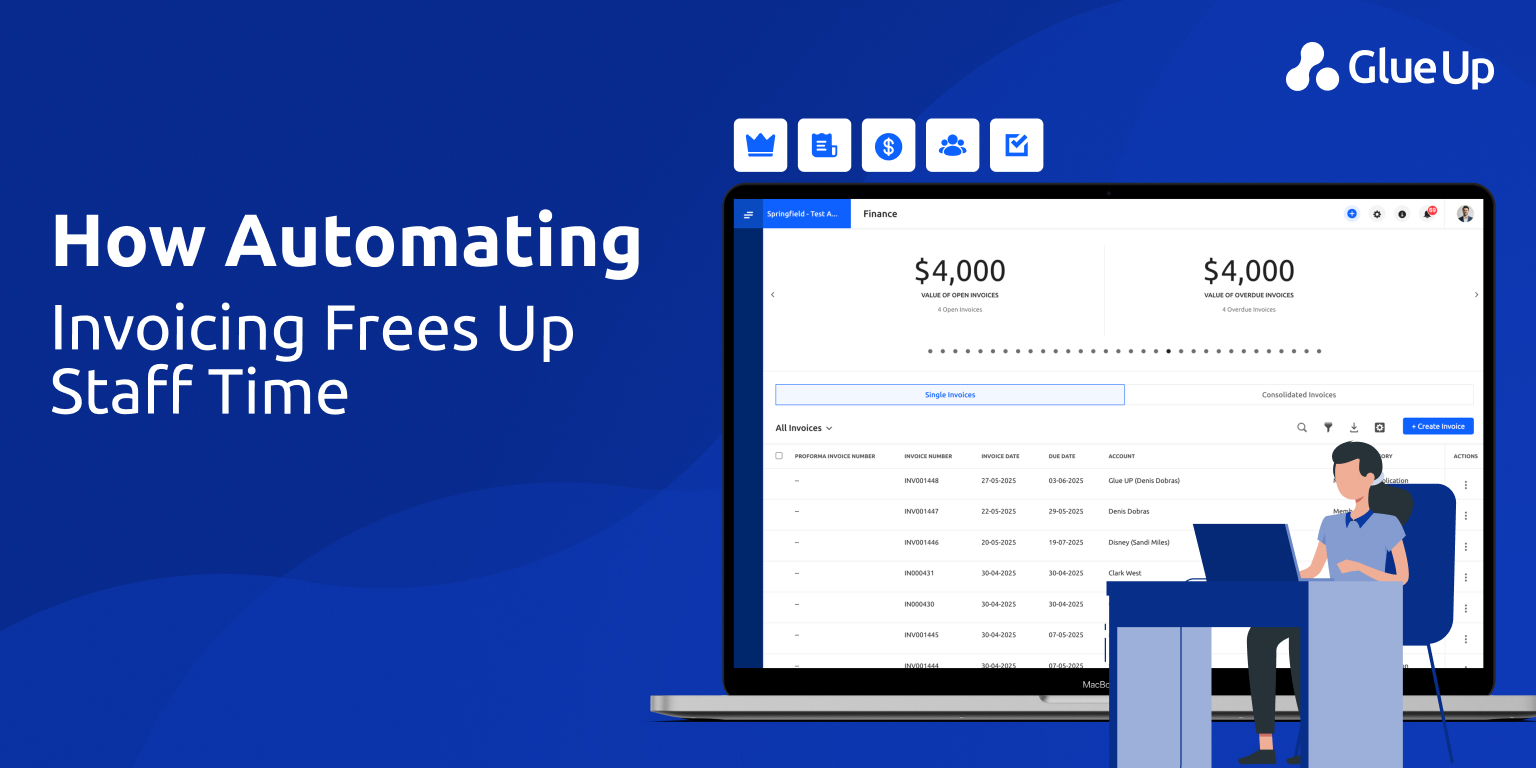

Integrated CRM and accounting synchronization ensures that membership data and financial records remain aligned. Automated invoice and receipt management reduces manual entry. Seamless data export for audit preparation supports clean documentation without last minute stress.

Glue Up enables this discipline by keeping dues activity structured from the moment it begins. Each transaction follows a defined path. Each adjustment remains visible. Each report draws from the same source of truth.

By the time fiscal year end arrives, finance teams review rather than rebuild. Planning conversations begin earlier. Confidence replaces urgency.

How Boards Interpret Financial Clarity In 2026

Board members read financial signals differently than staff teams.

They look for stability, consistency, and transparency. Automated dues revenue reporting delivers all three when implemented thoughtfully. Board treasurer financial summaries present revenue in context rather than isolation. Year over year comparisons highlight trends without exaggeration. Projected versus actual dues collection data supports measured discussion.

In 2026, boards expect clarity. Economic conditions, membership expectations, and sponsor scrutiny continue to rise. Leaders who arrive with well structured dues insights build credibility through preparation.

Glue Up supports board confidence by ensuring financial reports align with operational reality. Numbers connect back to membership activity. Explanations feel grounded. Questions receive direct answers.

That trust strengthens governance and accelerates decision making across the organization.

Membership Teams and the Power of Revenue Context

Membership directors live at the intersection of engagement and revenue.

Renewal forecasts shape outreach strategies. Tier performance informs benefit design. Automated dues revenue reporting gives membership teams the context they need to align programs with financial sustainability.

Multi tier dues structure tracking reveals which segments renew consistently and which require attention. Membership category revenue breakdown highlights where growth opportunities exist. Real time analytics support proactive engagement without pressure.

Glue Up connects membership workflows directly to financial outcomes. Teams see how engagement initiatives influence dues performance across cycles. Planning becomes informed by evidence rather than instinct.

As organizations prepare for the new fiscal year, this alignment reduces friction between departments and supports shared goals.

Historical Data as the Anchor for Future Planning

Future planning gains strength when it stands on a clear understanding of the past. For member based organizations, that clarity comes from historical data that stays consistent, connected, and easy to interpret across fiscal cycles. Year end conversations feel steadier when leaders share a common view of what actually happened, rather than piecing together partial records from different systems.

Historical data offers perspective that no single reporting moment can provide. It shows which revenue patterns held steady across years and which shifted in response to member behavior, pricing changes, or broader economic conditions. Automated dues revenue reporting preserves this perspective by maintaining clean, continuous records year after year, allowing trends to surface naturally instead of being reconstructed after the fact.

Through year over year revenue comparison, leadership teams see momentum clearly. Growth patterns become visible. Plateaus stand out. Deferred revenue recognition tracking brings timing into focus, helping leaders understand when dues were collected and when they were recognized within the fiscal year. Dues lifecycle tracking adds another layer, showing how members move through renewal stages across seasons, cycles, and membership terms.

Glue Up supports this continuity by carrying historical dues data forward without distortion. Membership records, invoices, payments, and renewals remain linked, ensuring that past performance stays accurate and comparable as organizations plan ahead. Leaders enter budgeting and strategy discussions with a grounded understanding of performance trends rather than assumptions shaped by incomplete snapshots.

For organizations preparing 2026 budgets, this discipline strengthens resilience. Decisions feel measured. Adjustments feel intentional. Planning becomes a process built on evidence, allowing leadership teams to move into the new fiscal year with confidence rooted in clarity.

Reducing Administrative Load While Strengthening Financial Integrity

Administrative work quietly shapes how much strategic thinking an organization can afford. In member based organizations, finance teams often carry responsibilities that stretch well beyond analysis and planning. Time gets absorbed by reconciliation, documentation, and manual checks, especially as the fiscal year draws to a close. Research across finance and accounting functions consistently shows that organizations gaining clarity at year end are the ones that reduce manual handling and rely on structured systems to maintain accuracy over time.

Industry studies from accounting and finance associations regularly highlight the same pattern: when routine financial processes stay automated and consistent, finance leaders shift from record keeping toward decision support. Automated dues revenue reporting plays a central role in that shift for associations, chambers, and professional groups where membership dues form the backbone of operating revenue.

Administrative Efficiency as a Strategic Lever

Efficiency inside finance teams directly influences planning quality. When fewer hours go into assembling data, more time remains for interpreting it. Automated dues revenue reporting supports this balance by simplifying recurring financial tasks that traditionally consume staff capacity during year end.

Reconciliation becomes steadier when invoices, payments, and member records remain connected from the start. Documentation stays complete because records update automatically rather than through manual intervention. Accounts receivable aging reports remain current, offering a clear view of outstanding balances without requiring separate tracking efforts.

Research from finance operations studies consistently shows that automated reporting environments reduce closing cycle time and lower the risk of reporting inconsistencies. For leadership teams, that translates into faster access to reliable information and fewer last minute corrections during planning discussions.

Compliance and Accuracy Through Consistent Systems

Financial integrity rests on consistency. Tax authorities, auditors, and boards all expect financial records to reflect the same logic across periods. Automated tax and VAT calculation supports this expectation by applying uniform rules across transactions and regions, reducing variability that often emerges through manual handling.

Deferred revenue recognition tracking further supports accuracy by aligning dues recognition with accounting standards, a topic frequently emphasized in association finance guidance and professional accounting research. When revenue timing stays transparent, financial statements feel easier to explain and defend during audits or board reviews.

Glue Up brings these elements together inside a single system. Digital payment processing via secure online methods feeds directly into financial records, ensuring that payment activity remains aligned with reporting outputs. Audit trail automation preserves accountability by maintaining a clear history of changes, approvals, and adjustments over time.

Financial Integrity That Builds Trust

Strong financial integrity builds trust internally and externally. Boards rely on consistent reports. Auditors look for traceable records. Leadership teams need confidence that numbers reflect reality rather than estimates. Automated dues revenue reporting supports this trust by reducing fragmentation and keeping financial data anchored to verified transactions.

Glue Up integrates membership, billing, and reporting capabilities in a way that reinforces data integrity across the organization. Financial data remains consistent across dashboards, exports, and summaries. Teams review information rather than reconstructing it. Confidence grows because records remain dependable across cycles.

The Strategic Payoff at Year End

The payoff of reduced administrative load appears most clearly during planning season. Conversations feel thoughtful rather than rushed. Finance leaders arrive prepared to discuss trends, timing, and implications instead of defending spreadsheets. Membership and executive teams engage with shared data that feels complete and current.

As organizations prepare for the new fiscal year, this balance between efficiency and integrity supports stronger decisions. Automated dues revenue reporting allows finance teams to contribute insight at the level leadership expects, strengthening both planning outcomes and organizational confidence moving into 2026.

What Changes When Dues Reporting Becomes a Shared Language

Every organization runs on conversations. Strategy, budgeting, and planning all depend on how well people understand the same information at the same time. When financial data lives in silos, those conversations fragment. When dues reporting becomes a shared language, organizations begin to move differently.

Automated dues revenue reporting acts as the translator. It aligns finance, membership, and leadership teams around a single, consistent view of reality. Numbers stop shifting depending on who presents them. Context stays attached. Meaning travels intact from one room to the next.

From Departmental Views to Organizational Understanding

Finance teams traditionally see dues through totals, timing, and reconciliation. Membership teams view the same dues through renewals, tiers, and engagement patterns. Leadership looks for sustainability, predictability, and confidence. When these perspectives remain disconnected, decisions slow down.

Automated dues revenue reporting brings these views together. The same underlying data supports multiple lenses without changing the story. Revenue totals align with member activity. Renewal performance connects directly to cash flow. Planning discussions rely on shared reference points rather than competing interpretations.

Glue Up enables this alignment by linking membership records, dues structures, invoices, and payments within one system. Each team accesses the information they need without reshaping it to fit separate tools or formats.

Planning Conversations Gain Precision

When dues reporting becomes a shared language, planning conversations sharpen. Finance teams speak in trends rather than transactions. Membership leaders understand how engagement efforts affect revenue stability. Executive directors frame decisions with clarity grounded in evidence.

Year-end planning reflects this precision. Budget discussions move forward faster. Tradeoffs feel informed. Questions receive direct answers because everyone works from the same data foundation.

Boards respond to this clarity. Financial summaries feel coherent rather than dense. Context arrives alongside numbers. Confidence grows as reports remain consistent across meetings and periods.

The Quiet Shift in Organizational Culture

The most meaningful change feels subtle. The system recedes. Conversations take its place.

In organizations using Glue Up, automated dues revenue reporting fades into the background as a dependable constant. Teams spend less time validating numbers and more time interpreting them. Trust replaces verification. Insight replaces assembly.

Over time, this shared language shapes culture. Collaboration improves because alignment feels natural. Planning gains rhythm. Leadership discussions center on direction rather than reconciliation.

When clarity takes center stage, organizations evolve. Decisions align more easily. Confidence carries forward. Dues reporting becomes more than a process. It becomes a common understanding that supports stronger planning year after year.

Why Automated Dues Revenue Reporting Defines Mature Organizations In 2026

Maturity shows up in preparation.

Organizations that plan well enter the new fiscal year with confidence rooted in understanding. Automated dues revenue reporting provides that foundation. It transforms routine transactions into meaningful insight. It supports leadership clarity when stakes feel high.

Glue Up enables this maturity by connecting membership activity to financial reporting through a unified platform. Automated dues revenue reporting becomes part of the organization’s operating rhythm rather than a seasonal task.

As 2026 approaches, member-based organizations that embrace this discipline position themselves to plan thoughtfully, communicate clearly, and lead with confidence.

Closing Reflection

Year-end numbers always exist.

What changes is how organizations listen to them.

Automated dues revenue reporting gives those numbers a voice leaders trust. It replaces uncertainty with clarity. It turns reflection into readiness.

For organizations preparing for the next fiscal year, that clarity makes all the difference.

Automated dues revenue reporting is the process of tracking, organizing, and presenting membership dues data through a structured system. It connects invoices, payments, renewals, and membership records into clear reports that support year-end reviews, board reporting, and future planning.

Year-end planning relies on clarity. Automated dues revenue reporting gives leadership teams a consistent view of dues collected, outstanding balances, and historical performance, helping them plan budgets, programs, and priorities for the new fiscal year with confidence.

Automated dues revenue reporting produces board-ready financial summaries that place revenue in context. Boards see trends, year-over-year comparisons, and projected versus actual dues collection data, making discussions more focused and decisions more grounded.

Glue Up unifies membership records, billing activity, and financial dashboards in one platform. Dues invoices, payments, renewals, and reporting stay connected, allowing organizations to view real-time insights without manual reconciliation or separate systems.

Yes. Automated dues revenue reporting supports audit trail automation, deferred revenue recognition tracking, and seamless data export for audit preparation. Financial records remain consistent, traceable, and aligned with accounting standards.

Membership teams gain visibility into renewal performance, tier behavior, and revenue impact. Automated dues revenue reporting connects engagement activity to financial outcomes, helping teams align outreach strategies with sustainable revenue goals.

Historical data provides perspective. Automated dues revenue reporting preserves year-over-year revenue comparisons, dues lifecycle tracking, and recognition timing, allowing leaders to base future planning on evidence rather than assumptions.

As organizations enter 2026, automated dues revenue reporting supports clearer planning, steadier board communication, and stronger financial discipline. It turns dues activity into insight leaders trust when shaping the next fiscal year.