At Glue Up, we’re actively keeping tabs on how regulatory changes are reshaping association operations across Europe. The upcoming PEPPOL e-invoicing framework is one of the most significant developments so far, driving a continent-wide shift toward interoperable, transparent, and data-driven financial ecosystems.

As the leading provider of association management software (AMS), we understand that this isn’t just a finance initiative. It’s a structural change that will influence compliance, governance, and how member organizations maintain financial credibility in a digital-first economy.

With Belgium and several EU countries moving toward mandatory e-invoicing compliance by 2026, association leaders now face a clear question: What does PEPPOL mean for us, and how can we stay ahead of it?

In this brief quick guide, you’ll:

Learn what PEPPOL e-invoicing is and why it matters for associations and chambers.

Understand how it fits into Europe’s evolving financial compliance landscape.

See how Glue Up’s Finance Module is progressing toward PEPPOL alignment.

Disclaimer: Glue Up is actively monitoring ongoing developments in PEPPOL implementation across Europe. This guide reflects our current understanding and will be updated as new information becomes available.

Key Takeaways

PEPPOL e-invoicing will become mandatory across Europe, starting with Belgium in 2026.

Associations should prepare now by reviewing their finance systems for UBL and BIS Billing 3.0 compatibility.

The PEPPOL network eliminates manual processing, creating secure, audit-ready invoice workflows.

Integrating your financial, membership, and event data helps ensure compliance and operational transparency.

Glue Up AMS provides a unified digital infrastructure designed for compliance, automation, and growth.

What Is PEPPOL and Why It Matters for Associations

If you oversee finance or compliance in a European association, you’ve probably heard about PEPPOL e-invoicing. Still, knowing what it actually does, and how it changes your day-to-day operations, is essential before new regulations take effect.

What PEPPOL Is

PEPPOL, short for Pan-European Public Procurement Online, is a framework created by the European Commission to standardize how invoices and other procurement documents move between systems across borders. You can think of it as the digital backbone of Europe’s e-invoicing ecosystem, a unified network where data, not PDFs, drives financial transactions.

The PEPPOL network operates through certified Access Points that verify, send, and receive invoices using the PEPPOL BIS Billing 3.0 specification. Each document follows the UBL invoicing format, a structured XML template that ensures every field from tax ID to line item is machine-readable and compliant.

This model replaces manual validation with automated checks at every stage. When you send an invoice through the network, the PEPPOL standard ensures it reaches its destination securely, with an embedded audit trail that tracks delivery, acceptance, and payment. For you, that means real-time accuracy, traceability, and fewer administrative errors.

Why It Matters to You

By 2026, EU e-invoicing regulation will require VAT-registered entities in countries, such as Belgium to issue and receive invoices electronically through the PEPPOL framework. That includes invoices for membership renewals, sponsorship packages, event registrations, and supplier payments; everything tied to your association’s financial activity.

Here’s why this change matters to your organization:

You’ll ensure compliance. Every invoice will automatically align with EU and national tax reporting requirements.

You’ll reduce manual workload. Automated e-procurement and validation minimize data entry and approval delays.

You’ll improve data visibility. Structured invoice data simplifies financial reporting, audit preparation, and forecasting.

You’ll operate seamlessly across borders. Certified PEPPOL Access Points allow your system to connect with public agencies, vendors, and members throughout Europe.

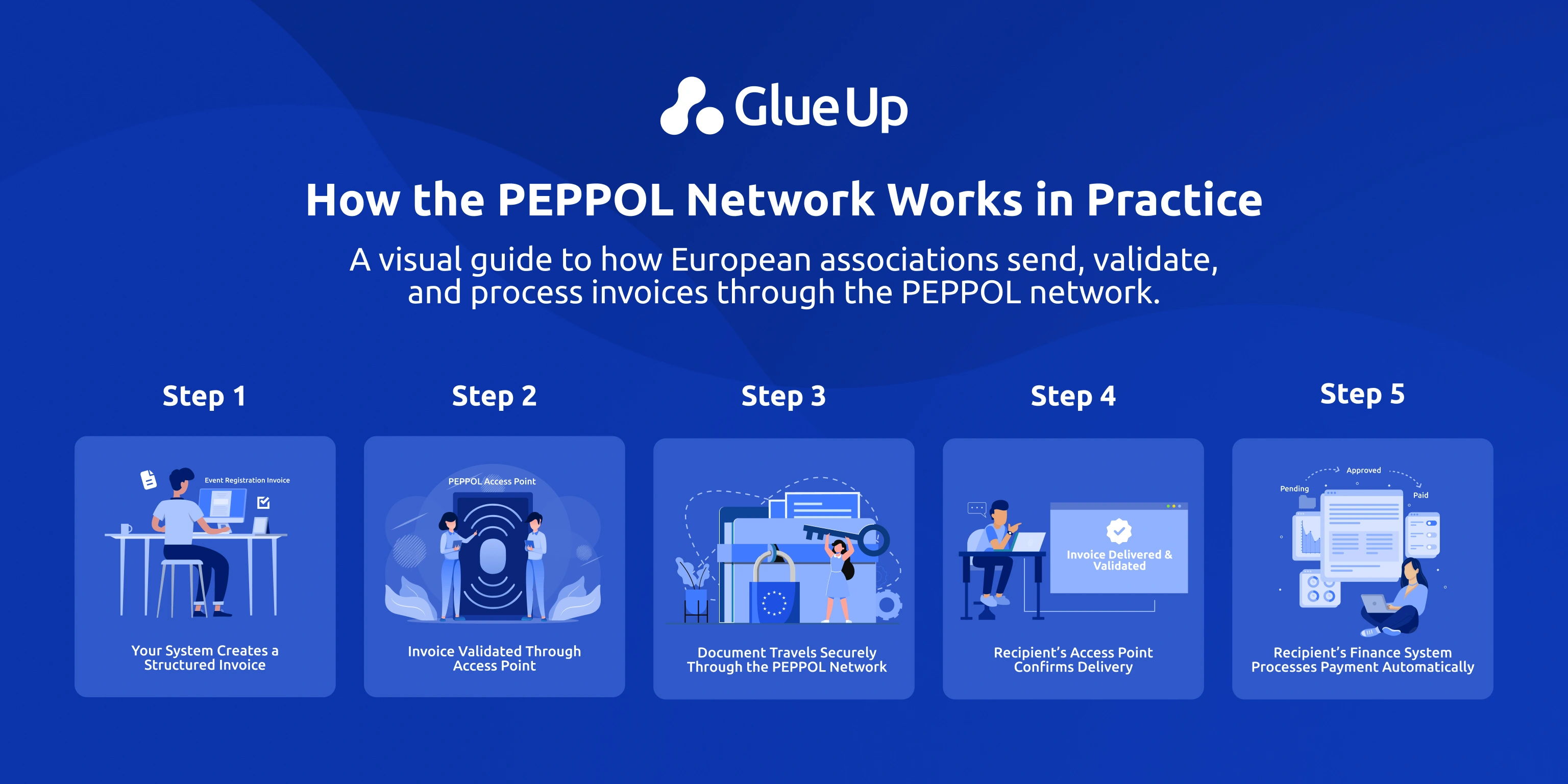

How the PEPPOL Network Works in Practice

To understand how PEPPOL e-invoicing works in real association settings, imagine a common scenario where your organization issues an invoice for an event registration or membership renewal. Once the invoice is created, every step of the process happens within the PEPPOL network to ensure accuracy, traceability, and compliance.

Your system creates a structured invoice

Instead of sending a PDF by email, your finance system generates a PEPPOL invoice using the UBL format. This structured format converts each detail, such as VAT numbers, line items, and tax amounts, into standardized data fields that can be verified automatically across systems.

The invoice is validated through your PEPPOL access point

Before the invoice leaves your system, it’s routed through a certified PEPPOL Access Point, which serves as your secure entry to the network. The access point checks that your invoice meets the PEPPOL BIS Billing 3.0 specifications and confirms that your recipient is registered within the network. These validations replace manual reviews and guarantee that your document meets both EU and national compliance rules.

The document travels securely through the PEPPOL network

After validation, the invoice is encrypted and transmitted to the recipient’s PEPPOL Access Point. Because all participants follow the same technical and structural standards, the document moves seamlessly across systems and borders without requiring additional configuration or email exchanges.

The recipient’s access point confirms delivery and validation

Once the invoice reaches the recipient’s Access Point, it is verified again. The system then sends an automated confirmation back to you, providing digital proof of receipt. This confirmation becomes part of your audit trail and removes the uncertainty of whether an invoice was received or processed.

The recipient’s finance system processes payment automatically

When the recipient’s accounting system receives the invoice, it can process the data immediately because it’s already in a structured format. This accelerates approvals, reduces reconciliation delays, and supports full e-invoicing interoperability between organizations.

Why This Matters in Day-to-Day Association Operations

This process transforms how your team manages financial workflows. You no longer have to follow up manually on unpaid invoices, manage inconsistent file types, or worry about cross-border compatibility. Every invoice you send is validated, traceable, and audit-ready, ensuring your financial records meet EU expectations for accuracy and transparency.

In practical terms, your invoices are:

Delivered securely and instantly within the PEPPOL network

Validated automatically through certified PEPPOL Access Points

Structured for compliance using BIS Billing 3.0 and UBL formatting

Recognized across borders, enabling cross-border invoicing and reporting consistency

The transformation isn’t just about automating invoices. It’s about creating a more resilient and transparent financial infrastructure that allows your association to operate confidently within Europe’s evolving digital economy.

Where Glue Up Fits In

If you’re managing an association, you already know that financial accuracy, automation, and data transparency define credibility. That’s where Glue Up’s association management software (AMS) helps you connect every process in one secure ecosystem.

As one of the most advanced AMS platforms in Europe, our all-in-one solution brings finance, membership, and engagement under one digital infrastructure, so you can operate efficiently while staying compliant.

Here’s how it can support your operations today:

Centralized Finance Management

Manage invoices, payments, refunds, and reports within a unified dashboard. You can set up tax rules, handle multiple currencies, and generate audit-ready workflows without manual reconciliation.

Automated Invoicing and Billing

Create and send invoices automatically after renewals, registrations, or sponsorship confirmations. Automation ensures accuracy and saves hours of administrative time.

Membership and Event Integration

Connect your financial data directly with your membership database and event modules. Every payment, discount, and renewal is tracked in real time, reducing gaps between finance and member operations.

Data Transparency and Reporting

Use real-time insights to analyze revenue trends, payment behavior, and outstanding balances. Built-in reporting tools help you make informed financial and governance decisions faster.

Scalability Across Chapters and Regions

Whether you’re managing one association or a network of chapters, Glue Up provides consistent financial processes across countries—critical for organizations operating in the European digital economy.

Accounting Integrations

Sync your financial data effortlessly with leading accounting systems such as Xero, Sage Intacct, and QuickBooks. These integrations eliminate double entry, keep your books accurate, and improve coordination between your finance and accounting teams.

Add-Ons for Ecosystem Expansion

Extend your capabilities with a growing suite of add-ons, including Community Management, chapter management suite, Zoom webinar, and Speed Networking. Tailor your AMS experience to your organization’s goals and digital maturity.

Get Ready for PEPPOL Compliance with Glue Up

Europe’s shift toward PEPPOL e-invoicing is reshaping how associations manage financial operations, compliance, and transparency. For association leaders, this change is more than a technical adjustment. It’s the foundation for smarter, more connected financial systems.

Glue Up is preparing its platform to meet upcoming PEPPOL compliance standards, ensuring associations across Europe can operate seamlessly within this new digital framework. Our commitment is to make the transition simple, automated, and fully integrated within your existing workflows.

We’ll continue to update this guide as new developments roll out and our alignment with PEPPOL certification advances.

In the meantime, you can book a demo to see how Glue Up’s all-in-one association management software (AMS) can help you automate financial processes, maintain compliance, and stay ready for the future of digital finance in Europe.

Frequently Asked Questions

What is PEPPOL e-invoicing?

PEPPOL (Pan-European Public Procurement Online) is a standardized digital framework that allows organizations to exchange electronic invoices and procurement documents securely and uniformly across Europe.

Is PEPPOL compliance mandatory for associations?

Yes, in many EU countries, including Belgium by 2026, all VAT-registered entities, including associations, chambers, and nonprofits, will be required to issue and receive invoices through the PEPPOL network.

What benefits does PEPPOL e-invoicing offer associations?

It ensures faster payments, improved accuracy, and fully traceable financial transactions. It also reduces manual data entry and enhances audit readiness through structured invoice data.

Do I need specific software to comply with PEPPOL standards?

Yes. Your association management software (AMS) or accounting system must be compatible with PEPPOL BIS Billing 3.0, UBL format, and certified PEPPOL Access Points.

How can Glue Up help with PEPPOL compliance?

Glue Up’s Finance Module is evolving to meet European e-invoicing standards. The platform already automates invoicing, supports multi-currency operations, and integrates with leading accounting software like Xero and QuickBooks.

Glossary of PEPPOL Terms

PEPPOL (Pan-European Public Procurement Online)

A European framework that standardizes e-invoicing and electronic document exchange between organizations.

PEPPOL e-invoicing

The process of issuing and receiving electronic invoices through the PEPPOL network using standardized formats and validation protocols.

PEPPOL Network

A digital infrastructure connecting public and private organizations through certified Access Points that handle secure document transmission.

PEPPOL Access Point

A certified gateway that validates, sends, and receives invoices according to PEPPOL specifications.

PEPPOL BIS Billing 3.0

The technical standard defining how invoices should be formatted and structured for interoperability within the PEPPOL system.

UBL (Universal Business Language)

A structured XML-based data format that enables machine-readable financial documents for automation and validation.

E-Procurement

The digital management of procurement and payment processes, including invoicing, approvals, and record-keeping.